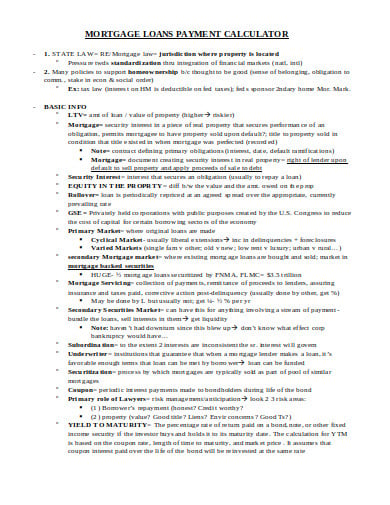

31+ Mortgage calculator rate change

Estimated monthly payments shown include principal interest and if applicable any required mortgage insurance. Use our mortgage calculator to get an idea of how much you could borrow find a mortgage and compare monthly rates and payments.

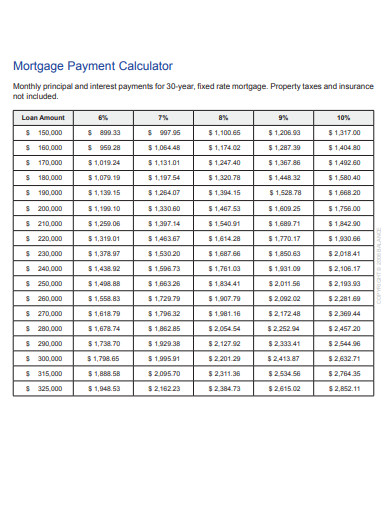

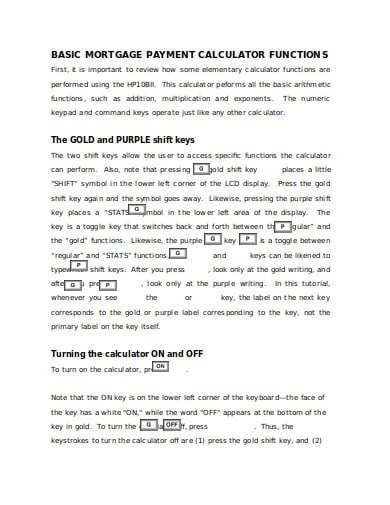

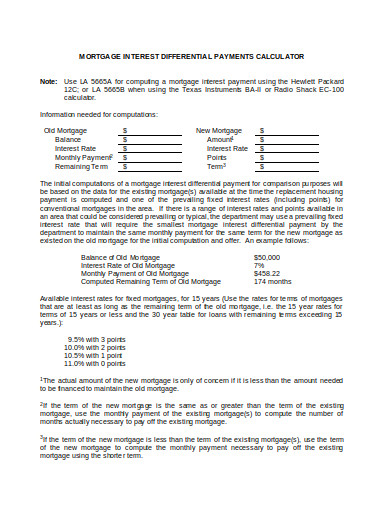

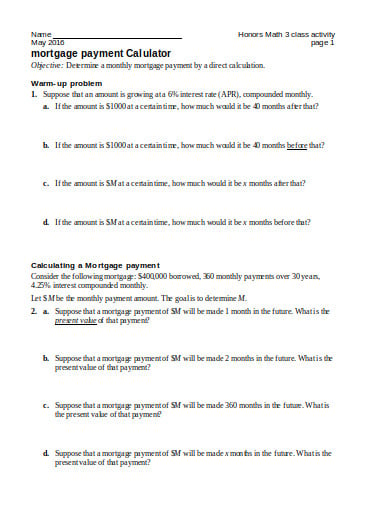

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

Sometimes deals look attractive because they have a low initial rate but you also need to take into account any fees that come with the mortgage deal.

. Todays national mortgage rate trends. Movers and Switchers who draw down a new mortgage by 31 December 2023. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3.

Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages. 2 Cashback on draw down of a. The monthly payment reflects both the repayment for the cash out at closing and your monthly mortgage payment.

This rate is available in Ontario Alberta and British Columbia. The maximum amount the loan interest rate is able to change during the first rate reset which happens after the initial introductory period of the loan. The one-year two-year three-year four-year five-year and seven-year mortgage terms.

331 discount for 5 years. The maximum amount the loan interest rate is able to change during the first rate reset which happens after the initial introductory period of the loan. Finally if you would like to change the extra payment amount after so many payments please try using the Loan Affordability Calculator which.

On Sunday September 04 2022 the current average 30-year fixed-mortgage rate is 608 increasing 20 basis points over the last seven days. As of January 10 2021 the average mortgage rate for a 30-year FRM is 265 APR while the average interest rate for a 15-year FRM is 216 APR. Toggle menu toggle menu path dM526178 313114L447476 606733L741095 685435L819797 391816L526178 313114Z.

The average interest rate for the most popular 30-year fixed mortgage is 548 according to data from SP Global. You can see the impact paying a. Borrowers that opt for a mortgage rate lock wont need to pay more if.

Central Daylight Time and assume borrower has excellent credit including a credit score of 740 or higher. A Smart Refinance loan is a no-closing-cost mortgage refinance option that lets you take advantage of lower rates get cash out at closing and change your loan term to 5 10 15 or 20 years. The average fixed-rate mortgage was priced at 191.

Calculate your monthly payments for a particular loan amount and interest rate using this mortgage calculator. This allows you to secure a lower rate and pay your mortgage earlier. Changing your mortgage rate type will change the mortgage terms available to you.

The current best high-ratio fixed mortgage rate in Quebec is 424. 65000 Principal Loan Amount. For example if you took a 30-year fixed-rate loan your payments will not change for the next 30 years.

The front-end DTI is 31 percent while the back end. Or if you are only interested in making monthly prepayments please visit the Prepay Mortgage Calculator. Request a callback.

In contrast the average variable rate mortgage was priced at. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. As long as you make consistent payments your debt should be paid off within 30 years.

Use our mortgage calculator to calculate how much you can borrow or try our mortgage repayment calculator to estimate your monthly repayments. Mortgage rates valid as of 19 Jul 2022 0933 am. If youve got a fixed rate mortgage you wont see any changes until the end of your fixed rate deal whilst if you have a variable rate mortgage you will see your monthly payments rise.

The 30-year jumbo mortgage rate had a 52-week low of 519 and a 52-week high of 607. The loan is secured on the borrowers property through a process. Fixed Rate Mortgage Loan Calculator.

35 Annual Real Estate Taxes. The United States also has a. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

Calculator Rates 3YR Adjustable Rate Mortgage Calculator. The current average interest rate on a 30-year fixed-rate jumbo mortgage is 605 010 up from last week. Please call us to discuss.

Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. If your mortgage rate changes you can use the calculator again to show what your payments would be on your new rate as well as the change to the total amount over the term. Mortgage Rate Change Calculator.

The following table compares costs between monthly mortgage payments and bi-weekly payments. The calculator below also accounts for other homeownership costs such as real estate taxes homeowners insurance and HOA fees. We then divide the total fees by the number of months the initial mortgage rate lasts to find the total fees per month.

Your lender will confirm whether an increase in interest rates will have an impact on your mortgage and what your new monthly payments will cost. 331 discount for 5 years. This mortgage calculator uses the most popular mortgage terms in Canada.

Your mortgage interest rate will most likely change at renewal. As of August 18 2022 the average 5-year fixed mortgage rate available from the Big 5 Banks is 532. If youve taken a 30-year FRM you can refinance to a 15-year term after a couple of years.

Calculator Rates 7YR Adjustable Rate Mortgage Calculator. This mortgage calculator shows you how much you would pay each month and over your mortgage term assuming the rate remains the same. This is regardless of whether index rates rise or fall.

NatWest mortgage rates calculator and review. Change your mortgage rate. Mortgage Enquiries 0330 433 2927.

Mortgage interest rates are always changing and there are a lot of factors that. This mortgage type offers a lower interest rate with other NatWest fixed rate mortgage products if the home youre purchasing or remortgaging has a. As of August 18 2022 the best high-ratio 5-year fixed mortgage rate in Canada is 419.

Locking a mortgage interest rate means that the rate attached to your mortgage wont change throughout the duration of your mortgages completion. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses. ARM interest rates and payments are subject to increase after the initial fixed-rate period 5 years.

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

![]()

How To Save Money Fast 3 Tricks Above 1000 Hr

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

![]()

How To Save Money Fast 3 Tricks Above 1000 Hr

31 Useful Interesting Excel Projects Ideas To Do At Home

Mortgage Calculator Valley West Mortgage

Pin On Family Fun Food Frugality Group Board

Azulejos Para Banos Pequenos Diseno De Banos Chicos Diseno De Banos

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

31 Cottonwood Trl Deming Nm 88030 Realtor Com

4 Mortgage Payment Calculator Templates In Pdf Doc Free Premium Templates

19 Sample Loan Application Letters Pdf Doc Free Premium Templates

Concept And Meaning Of Suspense Account And Utility Of Suspense Account Electrospun Materials And Polymeric Membranes Research Group

![]()

How To Save Money Fast 3 Tricks Above 1000 Hr

Pin On Savings Side Gigs Financial Success

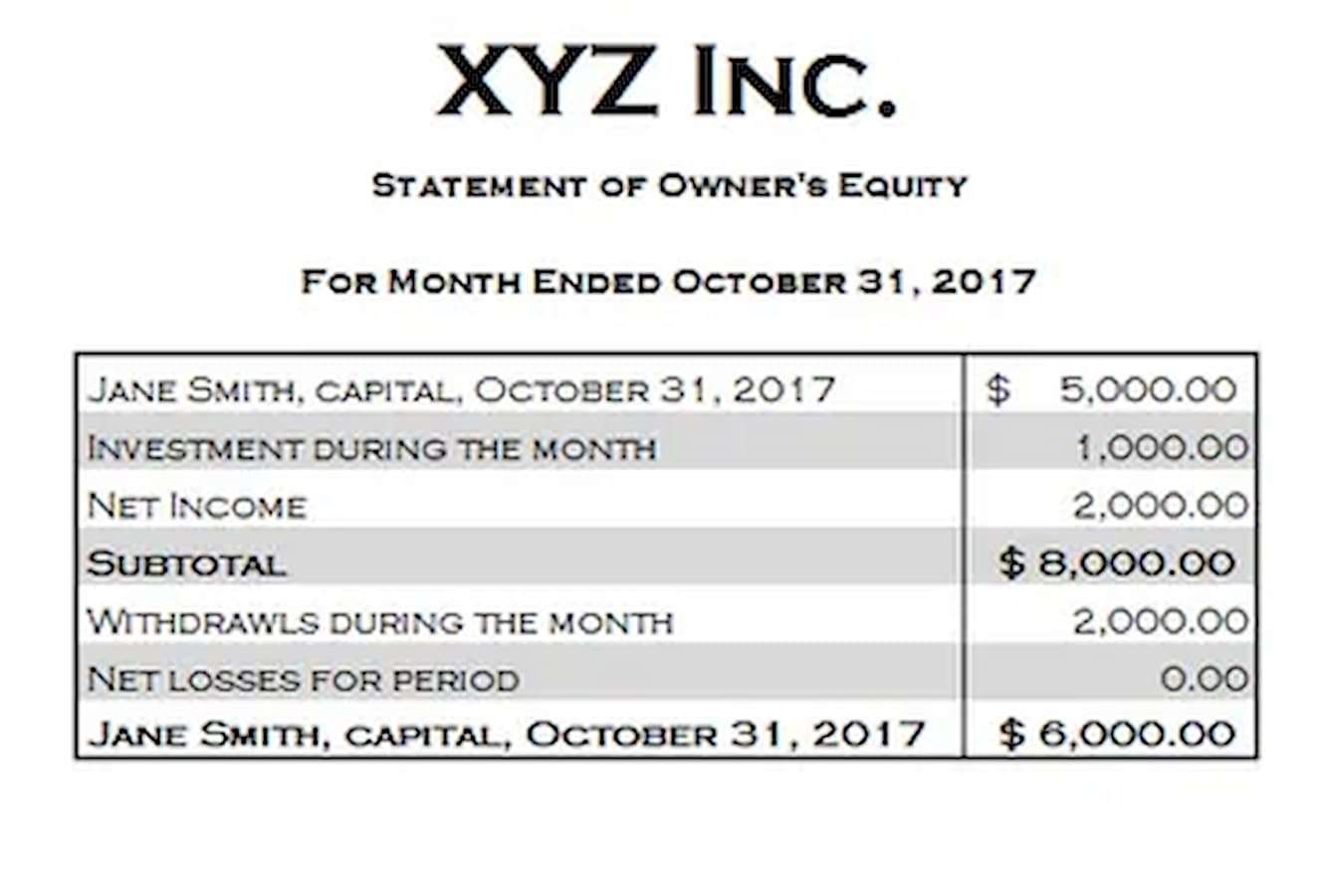

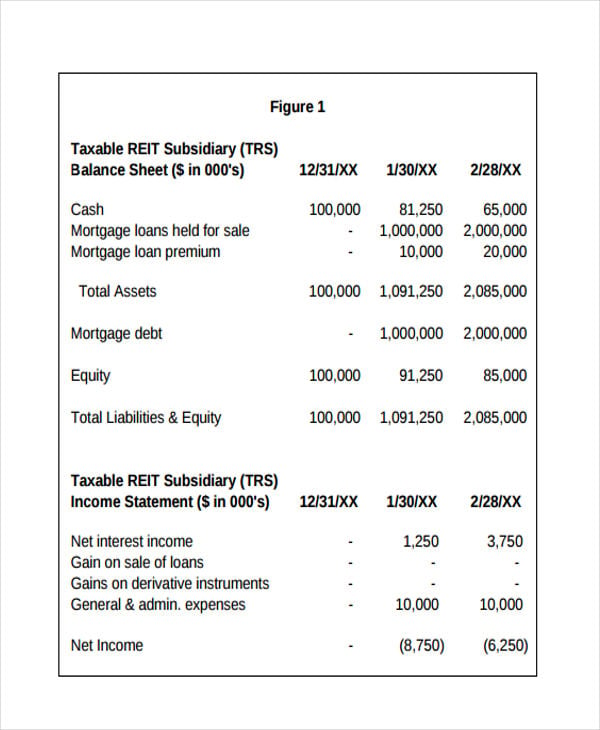

16 Balance Sheet Templates In Pdf Free Premium Templates